Book Details

The Coming Storm (Audiobook)

An Audible Original. Narrated by Michael Lewis.

Tornadoes, cyclones, tsunamis… Weather can be deadly–especially when it strikes without warning. Millions of Americans could soon find themselves at the mercy of violent weather if the public data behind lifesaving storm alerts gets privatized for personal gain. In his first Audible Original feature, New York Times best-selling author and journalist Michael Lewis delivers hard-hitting research on not-so-random weather data–and how Washington plans to release it. He also digs deep into the lives of two scientists who revolutionized climate predictions, bringing warning systems to previously unimaginable levels of accuracy. One is Kathy Sullivan, a gifted scientist among the first women in space; the other, D.J. Patil, is a trickster-turned-mathematician and a political adviser. Most urgently, Lewis’s narrative reveals the potential cost of putting a price tag on information with the potential to save lives, raising questions about balancing public service with profits in an ethically-ambiguous atmosphere.

Length: 2 hours and 27 minutes

Book Details

The Fifth Risk

In Stores Now

What are the consequences if the people given control over our government have no idea how it works?

“The election happened,” remembers Elizabeth Sherwood-Randall, then deputy secretary of the Department of Energy. “And then there was radio silence.” Across all departments, similar stories were playing out: Trump appointees were few and far between; those that did show up were shockingly uninformed about the functions of their new workplace. Some even threw away the briefing books that had been prepared for them.

Michael Lewis’s brilliant narrative takes us into the engine rooms of a government under attack by its own leaders. In Agriculture the funding of vital programs like food stamps and school lunches is being slashed. The Commerce Department may not have enough staff to conduct the 2020 Census properly. Over at Energy, where international nuclear risk is managed, it’s not clear there will be enough inspectors to track and locate black market uranium before terrorists do.

Willful ignorance plays a role in these looming disasters. If your ambition is to maximize short-term gains without regard to the long-term cost, you are better off not knowing those costs. If you want to preserve your personal immunity to the hard problems, it’s better never to really understand those problems. There is upside to ignorance, and downside to knowledge. Knowledge makes life messier. It makes it a bit more difficult for a person who wishes to shrink the world to a worldview.

If there are dangerous fools in this book, there are also heroes, unsung, of course. They are the linchpins of the system—those public servants whose knowledge, dedication, and proactivity keep the machinery running. Michael Lewis finds them, and he asks them what keeps them up at night.

Book Details

The Undoing Project: A Friendship that Changed Our Minds

"Brilliant. . . . Lewis has given us a spectacular account of two great men who

faced

up to uncertainty and the limits of human reason.”

—William Easterly,

Wall Street Journal

Forty years ago, Israeli psychologists Daniel Kahneman and Amos Tversky wrote a series of breathtakingly original papers that invented the field of behavioral economics. One of the greatest partnerships in the history of science, Kahneman and Tversky’s extraordinary friendship incited a revolution in Big Data studies, advanced evidence-based medicine, led to a new approach to government regulation, and made much of Michael Lewis’s own work possible. In The Undoing Project, Lewis shows how their Nobel Prize–winning theory of the mind altered our perception of reality.

Related Articles

“Michael Lewis and “The Undoing Project”: Why gut instincts are often wrong ” CBS News

“Review: Michael Lewis on Two Well Matched (but Finally Mismatched) Men” The New York Times

“From Michael Lewis, a Portrait of the Men Who Shaped 'Moneyball'” The New York Times

“How Two Trailblazing Psychologists Turned the World of Decision Science Upside Down” Vanity Fair

“Michael Lewis' latest 'Project' is brilliant” USA Today

“The Men Who Started a Thinking Revolution” Freakonomics Radio

Book Details

Flash Boys: A Wall Street Revolt

Four years after his #1 bestseller The Big Short, Michael Lewis returns to Wall Street to report on a high-tech predator stalking the equity markets.

Flash Boys is about a small group of Wall Street guys who figure out that the U.S. stock market has been rigged for the benefit of insiders and that, post-financial crisis, the markets have become not more free but less, and more controlled by the big Wall Street banks. Working at different firms, they come to this realization separately; but after they discover one another, the flash boys band together and set out to reform the financial markets. This they do by creating an exchange in which high-frequency trading—source of the most intractable problems—will have no advantage whatsoever.

The characters in Flash Boys are fabulous, each completely different from what you think of when you think “Wall Street guy.” Several have walked away from jobs in the financial sector that paid them millions of dollars a year. From their new vantage point they investigate the big banks, the world’s stock exchanges, and high-frequency trading firms as they have never been investigated, and expose the many strange new ways that Wall Street generates profits.

The light that Lewis shines into the darkest corners of the financial world may not be good for your blood pressure, because if you have any contact with the market, even a retirement account, this story is happening to you. But in the end, Flash Boys is an uplifting read. Here are people who have somehow preserved a moral sense in an environment where you don’t get paid for that; they have perceived an institutionalized injustice and are willing to go to war to fix it.

Video

"60 Minutes" correspondent Steve Kroft revealed Sunday night how a few

stock

market insiders are making billions in high-frequency trading. Kroft spoke with

Michael

Lewis, the author of "Flash Boys," about how insiders are raising the costs of

stocks

for ordinary investors.

"The Wolf Hunters of Wall Street," an adaptation from Flash Boys ( New York Times Magazine, 3/31/14)

"Fixing a Yawning Pothole on Wall Street," New York Times review by Janet Maslin

Book Details

Boomerang: Travels In The New Third World

“Lewis shows again why he is the leading journalist of his generation.”—Kyle Smith, Forbes

The tsunami of cheap credit that rolled across the planet between 2002 and 2008 was more than a simple financial phenomenon: it was temptation, offering entire societies the chance to reveal aspects of their characters they could not normally afford to indulge.

Icelanders wanted to stop fishing and become investment bankers. The Greeks wanted to turn their country into a pinata stuffed with cash and allow as many citizens as possible to take a whack at it. The Germans wanted to be even more German; the Irish wanted to stop being Irish.

Michael Lewis's investigation of bubbles beyond our shores is so brilliantly, sadly hilarious that it leads the American reader to a comfortable complacency: oh, those foolish foreigners. But when he turns a merciless eye on California and Washington, DC, we see that the narrative is a trap baited with humor, and we understand the reckoning that awaits the greatest and greediest of debtor nations.

Endorsements and Reviews

“The most significant business story since the days of Henry Ford. . . . Lewis achieves a novelistic elegance.” — Boston Globe

“Remarkable. . . . Clark proves to be a character as enthralling as any in American fiction or non-fiction. . . . [A] great story . . . with prose that ranges from the beautiful to the witty to the breathtaking.” — Fred Moody, Wall Street Journal

“A splendid, entirely satisfying book, intelligent and fun and revealing and troubling in the correct proportions, resolutely skeptical but not at all cynical.” — Kurt Andersen, New York Times Book Review

Video

Related Articles

“How the Financial Crisis Created a ‘New Third World’,” NPR's Fresh Air Interview

“Touring the Ruins of the Old Economy” New York Times review by Michio Kakutani

Book Details

The Big Short: Inside The Doomsday Machine

The #1 New York Times bestseller and now a major motion picture: “It is the work of our greatest financial journalist, at the top of his game. And it's essential reading.”—Graydon Carter, Vanity Fair

The real story of the crash began in bizarre feeder markets where the sun doesn't shine and the SEC doesn't dare, or bother, to tread: the bond and real estate derivative markets where geeks invent impenetrable securities to profit from the misery of lower- and middle-class Americans who can't pay their debts. The smart people who understood what was or might be happening were paralyzed by hope and fear; in any case, they weren't talking.

Michael Lewis creates a fresh, character-driven narrative brimming with indignation and dark humor, a fitting sequel to his #1 bestseller Liar's Poker. Out of a handful of unlikely-really unlikely-heroes, Lewis fashions a story as compelling and unusual as any of his earlier bestsellers, proving yet again that he is the finest and funniest chronicler of our time.

Trailer

Endorsements and Reviews

“No one writes with more narrative panache about money and finance than Mr. Lewis....[he] does a nimble job of using his subjects’ stories to explicate the greed, idiocies and hypocrisies of a system notably lacking in grown-up supervision....Writing in faintly Tom Wolfe-ian prose, Mr. Lewis does a colorful job of introducing the lay reader to the Darwinian world of the bond market.” — Michiko Kakutani, The New York Times

“Superb: Michael Lewis doing what he does best, illuminating the idiocy, madness and greed of modern finance. . . . Lewis achieves what I previously imagined impossible: He makes subprime sexy all over again.” — Andrew Leonard, Salon.com

“One of the best business books of the past two decades.” — Malcolm Gladwell, New York Times Book Review

“I read Lewis for the same reasons I watch Tiger Woods. I’ll never play like that. But it’s good to be reminded every now and again what genius looks like.” — Malcolm Gladwell, New York Times Book Review

Related Articles

“Betting on The Blind Side” an excerpt from The Big Short ( Vanity Fair, April 2010)

“Adam McKay on The Big Short 's 2015 release: 'We were a little surprised too'” an interview by Jeff Labrecque ( Entertainment Weekly, September 2015)

“Why Michael Lewis says Adam McKay gets the Wall Street Meltdown right in ‘The Big Short’” an article by Glenn Whipp ( Los Angeles Times, October 2015)

Book Details

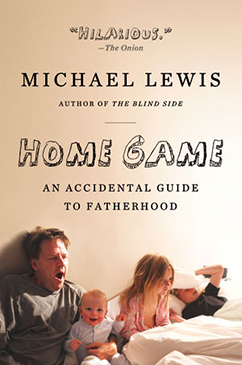

Home Game: An Accidental Guide To Fatherhood

The New York Times bestseller: “Hilarious. No mushy tribute to the joys of fatherhood, Lewis’ book addresses the good, the bad, and the merely baffling about having kids.” — Boston Globe

When Michael Lewis became a father, he decided to keep a written record of what actually happened immediately after the birth of each of his three children. This book is that record. But it is also something else: maybe the funniest, most unsparing account of ordinary daily household life ever recorded, from the point of view of the man inside. The remarkable thing about this story isn’t that Lewis is so unusual. It’s that he is so typical. The only wonder is that his wife has allowed him to publish it.

Endorsements and Reviews

“Brief, clever and frank—a good gift for Father’s Day.” — Kirkus Reviews

“Funny, frank, and engaging. It’s refreshing to hear a dad describe so vividly the uglier aspects of the job.” — Los Angeles Times

“His failings amuse . . . and he captures serious moments with a warmth that shows he’s a pretty good dad after all.” — People

Related Articles

“Reluctant Dad Fesses Up to Becoming Smitten Softly” New York Times review by Janet Maslin

“Pssst: Author Wants to Know the Real Poop” an excerpt from Home Game ( NPR, June 2009)

Book Details

Panic: The Story of Modern Financial Insanity

The New York Times bestseller: A masterful account of today’s money culture, showing how the underpricing of risk leads to catastrophe.

When it comes to markets, the first deadly sin is greed. In this New York Times bestseller, Michael Lewis is our jungle guide through five of the most violent and costly upheavals in recent financial history. With his trademark humor and brilliant anecdotes, Lewis paints the mood and market factors leading up to each event, weaves contemporary accounts to show what people thought was happening at the time, and, with the luxury of hindsight, analyzes what actually happened and what we should have learned from experience.

Endorsements and Reviews

“It’s hard to imagine a more timely book.” — BusinessWeek

“In this enlightening (and frightening) anthology, the Moneyball and Liar’s Poker author collects the best reporting and analysis of every Wall Street crisis of the past twenty years. As a source of aid in these troubled times, the book’s only competition is a bottle of Scotch.” — Details

Related Articles

“Investors Who Foresaw the Meltdown” New York Times review by Janet Maslin

“ ‘Liar's Poker’ Author Sees Upside to Market Crash” NPR’s Morning Edition Interview

Book Details

The Blind Side

“Lewis has such a gift for storytelling... he writes as lucidly for sports fans as for those who read him for other reasons.”—Janet Maslin, New York Times

When we first meet Michael Oher is one of thirteen children by a mother addicted to crack; he does not know his real name, his father, his birthday, or how to read or write. He takes up football, and school, after a rich, white, Evangelical family plucks him from the streets. Then two great forces alter Oher: the family's love and the evolution of professional football itself into a game in which the quarterback must be protected at any cost. Our protagonist becomes the priceless package of size, speed, and agility necessary to guard the quarterback's greatest vulnerability: his blind side.

Endorsements and Reviews

“It's not a jock book. It's not a sociology book. It's a storybook about modern society, ancient virtues, and the power of love, money and talent to do a little good.” — Jay Hancock, Baltimore Sun

“ The Blind Side is as insightful and moving a meditation on class inequality in America as I have ever read—although to put it that way, I realize, makes it sound deadly dull. It isn't.” — Malcolm Gladwell

“Lewis's overview of the evolution of NFL strategy... is not only sound but shrewder than that of many so-called football insiders who can't see the forest for the trees.” — Allen Barra, Washington Post

“[Lewis] is advancing a new genre of journalism.” — George F. Will, New York Times Book Review

“ The Blind Side works on three levels. First as a shrewd analysis of the NFL; second, as an exposé of the insanity of big-time college football recruiting; and, third, as a moving portrait of the positive effect that love, family, and education can have in reversing the path of a life that was destined to be lived unhappily and, most likely, end badly.” — Wes Lukowsky, Booklist

“Combining a tour de force of sports analysis with a piquant ethnography of the South's pigskin mania, Lewis probes the fascinating question of whether football is a matter of brute force or subtle intellect.” — Publishers Weekly

Video

Related Articles

“Book review: ‘The Blind Side’ by Michael Lewis” The Washington Post book review by Allen Barra

Book Details

Coach: Lessons on The Game of Life

There was a turning point in Michael Lewis's life, in a baseball game when he was fourteen years old. The irascible and often terrifying Coach Fitz put the ball in his hand with the game on the line and managed to convey such confident trust in Lewis's ability that the boy had no choice but to live up to it. "I didn't have words for it then, but I do now: I am about to show the world, and myself, what I can do."

The coach's message was not simply about winning, but about self-respect, sacrifice, courage, and endurance. In some ways, and even now, thirty years later, Lewis still finds himself trying to measure up to what Coach Fitz expected of him.

Endorsements and Reviews

“[Lewis] has such a gift for storytelling.” — New York Times

Related Articles

“Michael Lewis on Character Building and ‘Coach’,” NPR’s Weekend Saturday Interview

Book Details

Moneyball

Moneyball is a quest for the secret of success in baseball. In a narrative full of fabulous characters and brilliant excursions into the unexpected, Michael Lewis follows the low-budget Oakland A's, visionary general manager Billy Beane, and the strange brotherhood of amateur baseball theorists. They are all in search of new baseball knowledge—insights that will give the little guy who is willing to discard old wisdom the edge over big money.

Endorsements and Reviews

“This delightfully written, lesson-laden book deserves a place of its own in the Baseball Hall of Fame.” - Forbes

“The best book of the year, [ Moneyball] already feels like the most influential book on sports ever written. If you're a baseball fan, Moneyball is a must.” - People

“Lewis has hit another one out of the park.... You need know absolutely nothing about baseball to appreciate the wit, snap, economy and incisiveness of [Lewis's] thoughts about it.” - Janet Maslin, New York Times

“Moneyball is the best business book Lewis has written. It may be the best business book anyone;has written.” - Mark Gerson, Weekly Standard

“By playing Boswell to Beane's Samuel Johnson, Lewis has given us one of the most enjoyable baseball books in years.” - Lawrence S. Ritter, New York Times Book Review

“Ebullient, invigorating.... Provides plenty of action, both numerical and athletic, on the field and in the draft-day war room.” - Lev Grossman, Time

“A journalistic tour de force.” - Richard J. Tofel, Wall Street Journal

“Michael Lewis's beautiful obsession with the idea of value has once again yielded gold.... Moneyball explains baseball's startling new insight; that for all our dreams of blasts to the bleachers, the sport's hidden glory lies in not getting out.” - Garry Trudeau

“I understood about one in four words of Moneyball, and it's still the best and most engrossing sports book I've read in years. If you know anything about baseball, you will enjoy it four times as much as I did, which means that you might explode.” - Nick Hornby, The Believer

Video

Related Articles

“Three Strikes You're Out at the New Ballgame” New York Times review by Janet Maslin

“‘Moneyball’: Tracking Down How Stats Win Games” NPR’s Fresh Air Interview

Book Details

Next: The Future Just Happened

The New York Times bestseller.

With his knowing eye and wicked pen, Michael Lewis reveals how the Internet boom has encouraged changes in the way we live, work, and think. In the midst of one of the greatest status revolutions in the history of the world, the Internet has become a weapon in the hands of revolutionaries. Old priesthoods are crumbling. In the new order, the amateur is king: fourteen-year-olds manipulate the stock market and nineteen-year-olds take down the music industry. Unseen forces undermine all forms of collectivism, from the family to the mass market: one black box has the power to end television as we know it, and another one may dictate significant changes in our practice of democracy. With a new afterword by the author.

Endorsements and Reviews

“[C]onsistently smart, and its highpoints are among the high points of Lewis' writing life.” — New York Observer

“Next does not come too late to the crash-and-burn Internet book fest. It come just in time—at the speed of a falling safe.” — USA Today

“His book is a wake-up call at a time when many believe the net was a flash in the pan.” — BusinessWeek

Related Articles

“Data availability dampens authority” USA TODAY review by Henry Pearson

“ ‘Next: The Future Has Just Happened’, ” NPR’s Morning Edition Interview

Book Details

The New New Thing: A Silicon Valley Story

New York Times Bestseller

“A superb book. . . . [Lewis] makes Silicon Valley as thrilling and intelligible as he made Wall Street in his best-selling Liar’s Poker.” — Time

In the weird glow of the dying millennium, Michael Lewis set out on a safari through Silicon Valley to find the world’s most important technology entrepreneur. He found this in Jim Clark, a man whose achievements include the founding of three separate billion-dollar companies. Lewis also found much more, and the result—the best- selling book The New New Thing—is an ingeniously conceived history of the Internet revolution.

Endorsements and Reviews

“The most significant business story since the days of Henry Ford. . . . Lewis achieves a novelistic elegance.” — Boston Globe

“Remarkable. . . . Clark proves to be a character as enthralling as any in American fiction or non-fiction. . . . [A] great story . . . with prose that ranges from the beautiful to the witty to the breathtaking.” — Fred Moody, Wall Street Journal

“A splendid, entirely satisfying book, intelligent and fun and revealing and troubling in the correct proportions, resolutely skeptical but not at all cynical.” — Kurt Andersen, New York Times Book Review

Video

Related Articles

“Valley Guy” New York Times review by Kurt Anderson

“Betting on The Blind Side” an excerpt from The Big Short ( Vanity Fair, April 2010)

Book Details

The Money Culture

The classic warts-and-all portrait of the 1980s financial scene.

The 1980s was the most outrageous and turbulent era in the financial market since the crash of '29, not only on Wall Street but around the world. Michael Lewis, as a trainee at Salomon Brothers in New York and as an investment banker and later financial journalist, was uniquely positioned to chronicle the ambition and folly that fueled the decade.

Endorsements and Reviews

“One of our most entertaining writers. . . . The Money Culture rivals Liar's Poker in giggle-inspiring quality.” — BusinessWeek

“With Lewis's puckish humor and inimitable writing style, the stories are entertaining and thought-provoking.” — Library Journal

“Journalism of a high order. . . . Lewis's insouciance is one of his great charms as a writer, along with a graceful prose style, a mordant wit, and a thorough grounding in the world of finance. . . . One of those rare works that encapsulate and define an era.” — Fortune

“The funniest and most trenchant commentator on the money-mad moguls reshaping our world today.” — USA Today

Related Articles

“Yuks from Bucks” Businessweek review by review by Gary Weiss